The Make-or-Break Factor in M&A: Culture

“Think culturally – think historically.”

– Edgar Schein

Since the “Divorce of the Century” between Daimler and Chrysler in 2007, awareness has skyrocketed: cultural differences can make or break a merger. We know that up to 30% of failed post-merger integrations are directly tied to cultural clashes.

When Two Worlds Collide

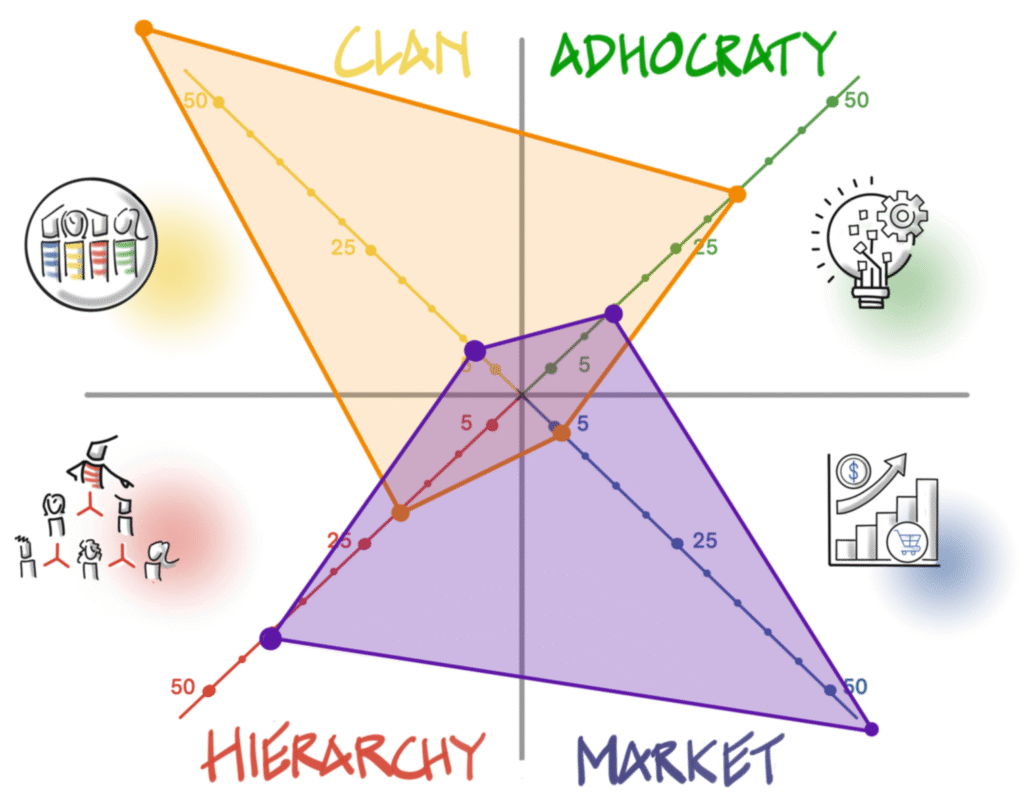

Consider two Swiss companies from the 90s: young, dynamic, competing against a dominant player. On paper, they looked like a perfect match — until I walked into their respectives headquarters:

- Reception: welcoming and relationship-driven vs. minimalistic and impersonal.

- Workspaces: flexible desks and home office vs. rigid cubicles behind closed doors.

- Organization: individual autonomy vs. tightly structured processes.

- Values: internally focused teamwork vs. outwardly focused customer engagement.

Finally, the merger didn’t take the cut.

OCAI (Organizational Culture Assessment Instrument)

Cross-Border Challenges

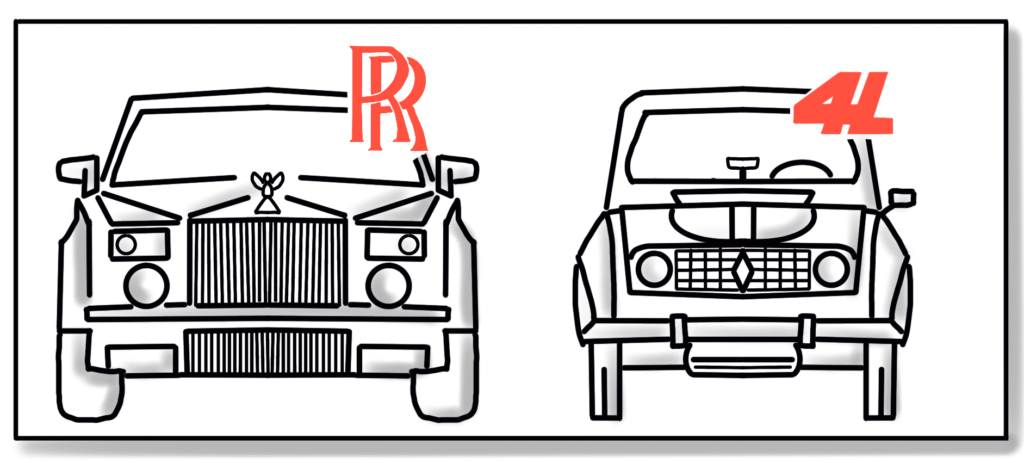

In another Swiss-French merger this time, cultural differences emerged quickly. The Swiss company built premium, high-precision products for a quality-obsessed market. The French partner thrived in developing markets, where price mattered more than perfection.

During a working meeting, a French executive told me jokingly:

“They are building Rolls-Royces for a market that needs Renault 4Ls.”

The merger never delivered the expected results and was considered a failure.

Why Culture Must Come First

Executives involved in both these M&A had learned a hard truth: analyzing culture before merging is non-negotiable.

Without clear cultural integration programs, even the best financial or operational synergies can be destroyed by silent, creeping resistance.

“Culture should always be analyzed prior to any strategic change.”

– Edgar Schein

→ In any merger, culture deserves as much attention as financial targets and operational synergies. Building cultural awareness across leadership teams and employees is essential to avoid costly misunderstandings — and to create a truly unified new organization.

* Kim S. Cameron and Robert E. Quinn, et. al, Competing Values Leadership – OCAI

* Edgar H. Schein, former professor at the MIT Sloan School of Management, Organizational Culture and Leadership and The Corporate Culture Survival Guide