The importance of culture in mergers and acquisitions

Ever since the DaimlerChrysler “Divorce of the Century” in 2007, after ten years of marriage due to unbridgeable differences in the cultures of the two organizations, the awareness that cultural differences can undermine the potential synergies of mergers and acquisitions (M&A) has risen. Uniting distinct corporate cultures into a new shared culture is one of the critical factors for M&A to achieve the transaction’s strategic and financial goals. Studies have nevertheless shown that cultural issues are at the heart of 30% of failed M&A integrations.

“Think culturally – think historically.”

– Edgar Schein

Two Swiss companies intended to merge. Both were founded during the nineties, both had a rather young and motivated workforce, and both competed on the same Swiss market against a bigger third player. However, the two companies had very different histories and backgrounds, headquarters in different geographical locations within Switzerland, and two contrasting company cultures.

Visiting both headquarters felt like visiting two different worlds to me.

- Reception: Warm, welcoming (couches and free fruits), relationship-based functional (furniture stripped to the minimum) and impersonal (interphone).

- Work space: Flex offices and home offices cubicles offices with closed doors.

- Working together: Flexible working hours and freedom to organize one’s own work fixed working hours and formal structures.

- Company values: Similar values, but internally oriented (used to define how we work together) externally oriented (used to define how we interact with our customers)

- Leadership, decision-making, internal communication styles, and external marketing approaches also varied greatly between the two companies.

In another case, a cross-border merger (Switzerland – France), different national cultures not only came into play, but also different markets and their respective customers’ needs and expectations. While the Swiss company was well established on a very quality-oriented local market, the French company was also active in a developing market, where price was considered more important than quality. A recurring witticism I heard from the French was that the Swiss company was building “Rolls-Royces” for the Swiss market, whereas what they needed were “Renaut 4L’s” for their developing market.

In both these cases, the boards of directors had experienced (painful) mergers and acquisitions (M&A) before, and were therefore aware of the importance of addressing the cultural parameters to ensure success.

“Culture should always be analyzed prior to any strategic change.”

– Edgar Schein

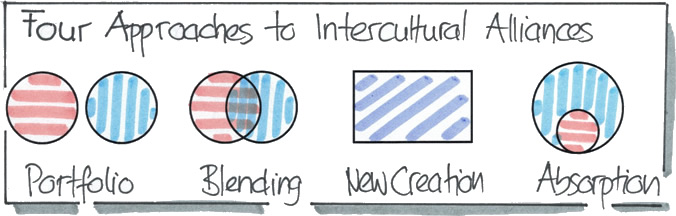

Considering the importance and impact culture will have on the post-merger integration process is key; it is at the same level as synergies, business performance and profit improvement. Analyzing the respective cultures prior to an M&A is, therefore, fundamental to anticipate the challenges that the blending of the two cultures will represent. This also includes defining culture integration programs to avoid culture clashes, which could potentially undermine the value of a deal.

→ Building sensitivity and awareness about cultural differences is vital to prevent cultural clashes or misunderstandings between the employees and boards of directors of both merging partners.

* Edgar H. Schein (born 1928), former professor at the MIT Sloan School of Management, author of “Organizational Culture and Leadership” and “The Corporate Culture Survival Guide”